The digital twins are also revolutionising the property insurance sector, as this technology is helping to improve the workflow of insurers in many areas. It speeds up claims assessment, detects fraud and enables more accurate risk assessment.

Claims management:

Digital twins speed up claims handling by making it easier and faster for the parties involved to establish the true extent of the damage. Virtual replicas provide a realistic picture of the damage site, automatically producing accurate measurements. It is also possible to include video, audio and text annotations in the models. The digital twins ensure that documents meet legal requirements and can be used in court.

Data security and risk mitigation:

Property insurance is a data-driven industry where accurate and centralised data is needed to make informed decisions. Digital twins give insurers access to more accurate data on property condition, size and damage incurred, helping them to make faster and better decisions. In addition, the technology will also help insurers address cybersecurity challenges, as the protection of personal data is a fundamental requirement. Matterport's digital twins, for example, can mask faces, remove personal data and provide secure metadata for files.

Optimising site visits:

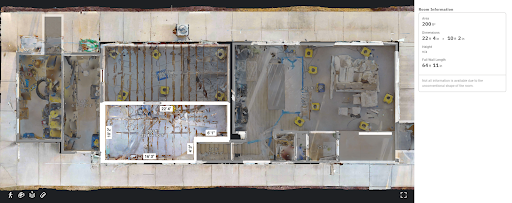

For insurers, one of the most costly and time-consuming tasks is to carry out on-site inspections. However, the use of digital twins can reduce the number of site visits required, as a single scan is sufficient to produce accurate measurements and floor plans. The technology allows insurers to access the necessary data remotely, saving time and money.

Fraud detection and ethical issues:

Insurers can easily check the veracity of claims, so they can more quickly identify conflicting claims. With virtual copies, insurers can accurately document the damage, which helps prevent fraud and set fairer premiums.

Restoration and disaster management:

Digital twins are particularly useful in disaster recovery work. The technology can help insurers and contractors provide faster and more accurate quotes for property restoration, speeding up the process and reducing costs.